Actualité

Trips Homes Informed me in under 4 Moments

Mise à jour : 3 octobre, 2024 à 17:52

Par https://www.linkedin.com/pulse/cheap-legit-essay-writing-services-top-3-picks-2024-intextcitation-vmsee

A secondary house is property other than most of your house which you use to own sport. Trips property routinely have some other funding requirements than simply often your primary domestic or a residential property. For those who earn any leasing earnings in the vacation family, you’ll also have to be conscious of the principles you to govern just how that earnings was taxed.

Let’s look closer during the travel belongings, the way you might use you to, and you can whether to acquire this type of secondary home is a idea to you personally.

Meaning and you will Types of Trips Residential property

The word a holiday house may sound rather noticeable: Its an extra possessions your household see on occasion and you may typically explore getting recreation. But not, it’s not as easy as just being an additional house. How often make use of it, whether you rent it, and even how far away its from your number 1 house get the connect with your property’s standing because the a holiday home.

- Approach labels: travel possessions, 2nd family, secondary home

Exactly how Vacation Land Works

Whenever you are managing a vacation domestic may appear enticing, it is critical to think about the facts which make this property distinctive from other sorts of home.

Such, you’ll generally speaking you need a more impressive down payment having a secondary home than simply you might getting an initial quarters-generally at the least 10%. You’ll also https://paydayloanalabama.com/malcolm/ need to meet a handful of important criteria generally necessary for lenders:

- You ought to inhabit the house to have the main season.

- It ought to be a one-tool hold.

- The property have to be obtainable seasons-bullet, and must not be a good timeshare otherwise fractional possession possessions.

- Your house really should not be work by a rental or assets administration team.

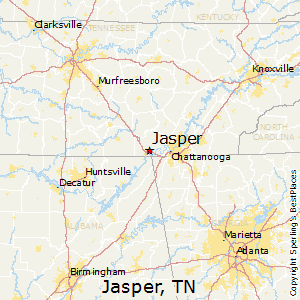

Particular loan providers require also a vacation assets be found a minimum range from your priple, your vacation household must become no less than 50 miles from your fundamental household.

If you are planning so you can rent your vacation household when you find yourself not using they, you’re going to have to believe prospective tax implications. Brand new Irs has also strict guidelines regarding just what qualifies as the a secondary assets. A holiday house qualifies due to the fact a home if you head to they private have fun with with the greater off 14 days otherwise ten% of the time your book it out (including, no less than 20 days when it is hired out to own 2 hundred days a year).

For individuals who rent out your trip house getting less than fifteen months annually, you don’t have to statement the money you earn. Yet not, you may not manage to subtract any expenditures, such as for example mortgage attention or possessions fees, given that leasing expenditures.

Trips House vs. Money spent

Prior to purchasing a holiday domestic, it is imperative to understand the differences when considering travel house and you will investment characteristics. The biggest basis is if you plan so you’re able to rent out your own travel possessions if you’re not using it, and if therefore, how often.

Such, the interest rate you are getting on the home loan get count on how the bank viewpoints your home. In the event it qualifies because the a secondary domestic instead of a financial investment possessions, you happen to be entitled to lower rates. You may need to commit to extra lender requirements, such agreeing that the family will never be leased aside for over 180 months a year.

Irs legislation don’t need one statement occasional local rental earnings regarding your trip family, provided they qualifies since an individual home and you also lease it to possess less than fifteen weeks a year. Although not, investment property rental money should be integrated on your tax go back. The bonus would be the fact you’ll also manage to deduct leasing expenses such as repairs, resources, and you may insurance.

Was a vacation Home Beneficial for you?

Choosing even when a holiday residence is a great fit for you is actually an individual decision. There are many affairs in which to order a secondary household could be a good idea to you, specially when you are looking and then make a financial investment. Like many a home, travel house have the opportunity to generate collateral. You’ll be able to have the ability to rent your trip home if you’re staying away from they, that will would a great income load.

Although not, you will also want to consider how often you are able to visit your vacation domestic. Since many lenders will need your vacation the home of be found a beneficial distance from your number 1 quarters, you will have to reason behind travelling some time will cost you, particularly if the trip will demand plane traveling. Failing woefully to spend much time at your travel family and you can leasing it out often could possibly turn your trip house with the an investment property, that will apply at your fees.

Next house come with an increase of costs, in addition to mortgages, property fees, insurance, and you may maintenance expenses. Consider these expenses before you buy to find out if a secondary domestic commonly match your allowance.

Dernières actus LeGamer.com:

- 3/10/2024: The pace to your a floating-price financing changes on a regular basis, therefore you’ll be able to spend a separate count anytime it transform

- 3/10/2024: The initial thing you should do in terms of refinancing should be to think how you’ll pay off the loan

- 3/10/2024: Trips Homes Informed me in under 4 Moments

- 3/10/2024: Are you willing to Score Property Collateral Mortgage And no Earnings?

- 3/10/2024: Is an online payday loan Repayment or Revolving?