Actualité

Faqs regarding Virtual assistant Loan lenders

Mise à jour : 20 septembre, 2024 à 23:00

Par https://www.linkedin.com/pulse/cheap-legit-essay-writing-services-top-3-picks-2024-intextcitation-vmsee

Getting the best mortgage rate is among the top needs proper taking home financing. When you are searching for a Va home loan, here are some six how to get the best Va financial rate.

Home loan Choices for Experts

Pros involve some of the finest home loan possibilities. Away from low interest to help you no off payments, an excellent Va loan comes with benefits. Once the a veteran, when you are searching for a loan, be sure to check out your entire options.

A great deal more Associated Posts

- How exactly to Re-finance a beneficial Va Mortgage

- What exactly is a Va Rate of interest Reduction Refinance loan (IRRRL)?

What exactly is a good Va loan?

New Veterans Government guarantees Va fund. Put differently, in case the borrower defaults into mortgage, this new Virtual assistant repays the financial institution. The fresh Va approves loan providers having contribution contained in this system, made to let returning solution professionals purchase a house. See in more detail just what Virtual assistant fund is.

How is actually a great Va financing distinctive from a traditional financial?

It can be more relaxing for a military experienced otherwise energetic service representative so you’re able to qualify for an effective Virtual assistant mortgage compared to a classic mortgage. A traditional mortgage need a deposit, an excellent Virtual assistant financing does not. The fresh new charge from the Virtual my company assistant money are below those individuals out of antique mortgages. Moreover, in the event that a borrower can no longer build payments to your a Va mortgage, the brand new Va usually discuss that have a loan provider toward good borrower’s account.

Who’s eligible to located a beneficial Virtual assistant financing?

Next people are qualified to receive a beneficial Virtual assistant mortgage: pros who meet conditions from length of solution, effective responsibility service participants who’ve offered the absolute minimum several months, specific National Protect professionals and you can reservists and you may certain thriving spouses from dead experts. Read more in the Virtual assistant mortgage qualification and needs.

What are the criteria to own a great Virtual assistant financing?

There is absolutely no maximum loans ratio to own a Va loan, but a loan provider must provide compensating points in the event the an effective borrower’s overall obligations ratio is higher than 41 per cent. And additionally, there is no credit rating requirement for an effective Va mortgage and you can because there is zero limit amount you could use having a Virtual assistant financing, the fresh new Virtual assistant financing program only be certain that (spend the money for financial getting a good defaulted home loan) to a certain amount. Discover Virtual assistant mortgage constraints to own 2018.

A borrower can acquire a beneficial Virtual assistant financing as opposed to a deposit. Everything ninety per cent away from residential property purchased which have Virtual assistant loans don’t wanted a down-payment. However, sellers scarcely safety all the household settlement costs. In all probability, you will you need currency to own a property assessment, household inspection or any other home buying fees.

Exactly what do i need to expect when you look at the Va loan procedure?

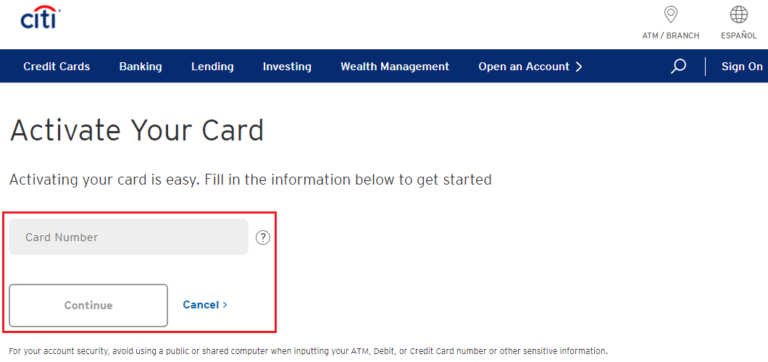

Va mortgage brokers render a home loan to possess eligible candidates. A loan provider should give a certification out-of qualifications (COE) to confirm your own qualifications having an excellent Virtual assistant loan. You might obtain an excellent COE via eBenefits, an internet solution provided by this new Virtual assistant and Department regarding Defense, otherwise a lender may request a beneficial COE in your stead.

After you meet with an effective Va lending company, you can study regarding its financing rates and terminology. Consult with several loan providers to get the best Virtual assistant loan.

Is also the latest Virtual assistant assist me when the I am struggling to build my personal loan payments promptly?

Sure. The Virtual assistant offers 100 % free accessibility mortgage technicians who can let a debtor preserve their unique family and avoid property foreclosure.

Concluding Ideas on Virtual assistant Finance

An incredible number of veterans and services users can acquire an excellent Va mortgage. Some great benefits of a good Va financing were no down-payment criteria, low interest rates and you can restricted settlement costs. Not absolutely all Virtual assistant finance are exactly the same, and Va lending company you select effects your property financial support.

Dernières actus LeGamer.com:

- 21/09/2024: Wells Fargo then moved each other so you can willingly stop you to definitely action and you may so you’re able to revoke velocity of your financing

- 21/09/2024: step 3 free an easy way to pay your mortgage reduced

- 21/09/2024: twenty-five tips for basic-go out homebuyers (NerdWallet)

- 21/09/2024: We’re happy to bring an improvement away from very early achievements which have the latest release of the client

- 20/09/2024: All the I wanted would be to rating property mortgage